Understanding the Basics of Trading

Trading is the act of buying and selling financial instruments such as stocks, bonds, currencies, and commodities with the aim of making a profit. To make money off trading, you need to understand the market, develop a strategy, and manage your risks effectively.

Choosing the Right Platform

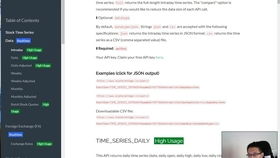

Before you start trading, it’s crucial to choose the right platform. There are numerous trading platforms available, each with its own set of features and fees. Some popular platforms include TD Ameritrade, ETRADE, and Robinhood. Consider factors like ease of use, fees, and available resources when selecting a platform.

Developing a Trading Strategy

A trading strategy is a set of rules and guidelines that you follow when making trading decisions. There are various types of trading strategies, including day trading, swing trading, and position trading. Here are some key elements to consider when developing a trading strategy:

-

Market Analysis: Understand how to analyze the market using technical and fundamental analysis. Technical analysis involves studying price charts and using indicators to predict market movements. Fundamental analysis involves analyzing financial statements and economic indicators to assess the intrinsic value of a security.

-

Entry and Exit Points: Determine the conditions under which you will enter and exit a trade. This includes setting price targets and stop-loss levels to manage your risk.

-

Asset Selection: Choose the financial instruments you want to trade based on your strategy and risk tolerance.

-

Position Sizing: Decide how much capital to allocate to each trade based on your risk tolerance and the size of your trading account.

Managing Risk

Risk management is a critical aspect of trading. Here are some key risk management techniques:

-

Stop-Loss Orders: Set a stop-loss order to limit your potential losses on a trade.

-

Position Sizing: Allocate a percentage of your trading capital to each trade to avoid overexposure.

-

Asset Diversification: Spread your investments across different asset classes to reduce risk.

Continuous Learning and Adaptation

The financial markets are constantly evolving, so it’s essential to stay informed and adapt your strategy as needed. Here are some tips for continuous learning and adaptation:

-

Stay Informed: Keep up with financial news, market trends, and economic indicators.

-

Backtest Your Strategy: Test your trading strategy using historical data to see how it would have performed in the past.

-

Review Your Trades: Analyze your trading performance regularly to identify areas for improvement.

Table: Comparison of Trading Platforms

| Platform | Commissions | Features | Minimum Deposit |

|---|---|---|---|

| TD Ameritrade | $6.95 per trade | Research tools, mobile app, educational resources | $0 |

| ETRADE | $6.95 per trade | Research tools, mobile app, educational resources | $0 |

| Robinhood | Free trades | Mobile app, social features, educational resources | $0 |

Building a Profitable Trading Portfolio

Building a profitable trading portfolio requires patience, discipline, and a well-defined strategy. Here are some tips to help you build a successful trading portfolio:

-

Start Small: Begin with a small trading account and gradually increase your investments as you gain experience.

-

Focus on High-Quality Stocks: Invest in companies with strong fundamentals and a solid track record.

-

Use Diversification: Spread your investments across different sectors and asset classes to reduce risk.

-

Stay Disciplined: Stick to your trading plan and